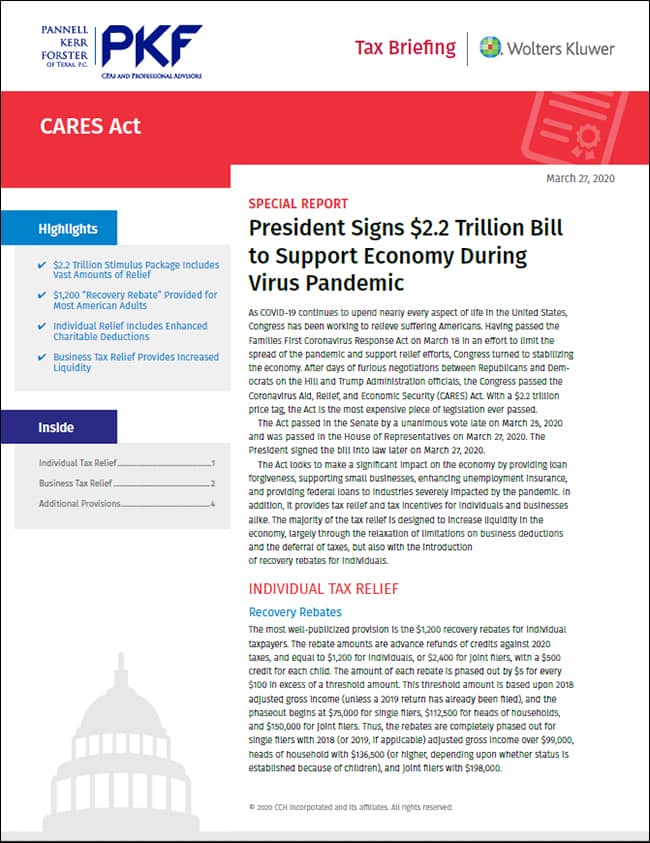

On Friday, March 27th, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act provides support to both individuals and businesses, including changes to tax policy.

With this in mind, we want to share with you a special tax briefing which summarizes the following:

- Recovery Rebates

- Payroll Tax Deferral Provisions

- Expanded NOL Utilization and Carryback Provisions

- Employee Retention Credits

- Unlimited Charitable Deductions for 2020

- Expanded Business Interest Expense Deductibility

The briefing may be downloaded here or by clicking the image above.

If you have questions about how the information in this briefing applies to your tax situation, please connect with your specific PKF Texas tax team members via email.

Additionally, we are keeping PKFTexas.com/COVID-19 up-to-date with information and resources to assist you as we all navigate these quickly-changing times.